VideoCX.io Launches Secure, Humanized Video Banking Platform for U.S. Financial Institutions

AWS-backed platform powering 3M+ monthly video banking calls expands to the U.S., bringing secure, AI-driven digital engagement for banks.

NEW YORK, NY, UNITED STATES, November 17, 2025 /EINPresswire.com/ -- As U.S. banks face the dual challenge of declining branch foot traffic and rising operating costs, the need for secure, humanized digital interaction has never been greater. Enter VideoCX.io, an AWS-backed global video banking platform that already powers more than 3 million secure banking video calls every month across Asia and other international markets.Founded in 2017, VideoCX.io has become one of the most feature-rich video banking platforms globally, trusted by over 75 banks, lenders, and insurance firms in regions such as India, Singapore, Brazil, Turkey, and Thailand. The company is now bringing its proven platform to the United States to help financial institutions replicate the trusted branch experience virtually.

The Human Touch in Digital Banking

Branch closures have accelerated across the United States, with more than 2,900 bank branches shuttered in 2023 alone, according to S&P Global Market Intelligence. Yet customers continue to demand personalized, high-touch interactions for services like account onboarding, loan consultations, and wealth management.

VideoCX.io bridges this gap by offering a branch-like experience over secure, high-definition video. Customers can connect with their banker anytime, from anywhere, using a laptop or mobile device, while banks retain full control and compliance through enterprise-grade security.

30 to 40% of account applications are abandoned mid-way due to friction (as per Deloitte).

VideoCX can rescue incomplete applications by prompting a “Talk to a banker now” video flow which can drastically improve completion rates.

“Video banking is not simply a reaction to fewer branch visits. It represents the next generation of customer convenience,” said Rudrajeet Desai, Founder & CEO of VideoCX.io. “Imagine a working professional completing their mortgage discussion during a lunch break, or a senior citizen getting real-time guidance on an insurance claim from home. Every interaction becomes faster, simpler, and more personal. For banks, the cost efficiencies are equally transformative. A National Video Branch can save over one million dollars in the first year from a single branch and over 20 million dollars across ten branches in five years.”

Banks lose engagement post-account creation. Few customers ever speak to a real banker again. VideoCX enables real-time consultations, cross-selling, and service recovery through integrated video calls inside the banking app or website.

With VideoCX.io, banks can deliver services like secured, complaint onboarding, customer support, loan underwriting, and financial advisory through video, reducing infrastructure expenses while providing unmatched customer convenience.

Enterprise-Grade Banking on Video

The platform is designed to integrate seamlessly into a bank’s existing website or mobile app, delivering secure end-to-end digital journeys that mirror in-branch processes, only faster. In India, for instance, DBS Bank uses VideoCX.io to onboard customers and complete video KYC in under five minutes. Other institutions such as AU Small Finance Bank, Axis Bank, and Yes Bank now handle services ranging from fund transfers to wealth advisory fully through video.

Insurance leaders including HDFC Life, Aditya Birla Capital, and Max Life also rely on VideoCX.io to process claims, perform remote medical checks, and manage policy servicing securely.

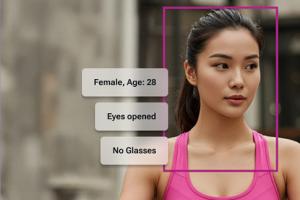

Key capabilities include AI-powered face match, liveness detection, real-time translation, deepfake detection, and speech-to-text transcription, ensuring both convenience and enterprise-grade security.

AWS-Backed and Globally Proven

As an AWS Global ISV Accelerate Partner, VideoCX.io has co-published five global case studies with AWS showcasing how its platform reduces verification time from days to seconds, improves operational efficiency by 30 percent, and enables 24/7 financial service delivery.

The company has also been recognized as AWS Business Solutions Partner of the Year (2021) and is listed on the AWS Marketplace, making it easily accessible to banks seeking secure, scalable video engagement solutions.

Designed for the U.S. Market

For U.S. deployments, VideoCX.io offers two flexible hosting options: deployment in the bank’s own AWS account or a hybrid SaaS model hosted in the AWS U.S. East (New York) region. Both approaches ensure compliance with U.S. data residency and financial regulations while giving institutions full control over their security and storage infrastructure.

“Banks in the U.S. are under pressure to balance cost reduction with customer experience,” said Desai. “Our solution enables them to achieve both, bringing high-value interactions onto secure, AI-enabled video that is fully compliant and enterprise-ready.”

As Gen Z expects face-to-face digital interactions, not phone trees or chatbots, banks need richer touchpoints. VideoCX enables personalized, face-driven banking. A huge gap in most U.S. institutions’ digital strategy.

About VideoCX.io

VideoCX.io is a global enterprise-grade video banking platform founded in 2017. Backed by SRI Capital and Better Capital, the company is headquartered in India with a 40-member team serving clients worldwide. Its technology is trusted by over 75 financial institutions and processes more than 3 million secure video calls monthly. VideoCX.io empowers banks and insurers to deliver remote, branch-like customer experiences powered by AI and hosted securely on AWS.

For more information, visit https://us.videocx.io/

Kaizad D. Shroff

WorkApps Product Solutions Private Limited

kaizad@videocx.io

Visit us on social media:

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.