Leyden Township Taxpayers Have Until September 2, 2025, to File Informal Appeals

O'Connor discusses how Leyden Township taxpayers have until September 2, 2025, to file informal appeals.

CHICAGO, IL, UNITED STATES, August 28, 2025 /EINPresswire.com/ --The 2025 reassessment of northern Cook County has been one for the record books. While not like the earth-shattering disaster of the 2023 reassessment of the core of Chicago, taxpayers across the north have seen ridiculous values placed on their homes and businesses. Coupled with rising tax rates, the upcoming tax bills are going to be the highest ever seen in the area. This is not a gradual ramping up of costs either, but a hard spike that is instantly transforming many properties from long-term investments to unaffordable anchors around the necks of taxpayers.

Leyden Township is at the heart of these value surges. Homeowners are experiencing a 21% rise in value, while business owners are seeing an increase of 42% in total taxable value. While any exemptions in place are helping, the only alternative to lower these untenable values is a property tax appeal. These have already paid dividends across Cook County and even the Cook County Assessor’s Office (CCAO) is encouraging their use. Unlike the rest of Illinois, Cook County townships have multiple deadlines for appeals, giving taxpayers multiple chances to file before it is too late. The deadline for informal appeals in Leyden Township is September 2, 2025. O’Connor will explain how the reassessment has affected property values across the township and what options taxpayers have to challenge them.

Leyden Homes Surge 21% in Taxable Value

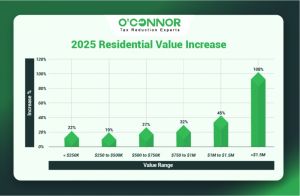

Leyden Township has a long history of being a bastion for working families and middle-class people, one that could be in jeopardy if home values continue to rise. The overall value of homes in Leyden Township increased 21%, going from $7.11 billion to $8.64 billion. Values have already been creeping up outside of reassessment, so this is a big blow to the average person just trying to stay in their home. This will also lead to increased rents across the area, making things worse.

Most value in the township is created by modest homes. The largest block is residences worth between $250,000 and $500,000. These homes rose 19% in value, totaling $5.90 billion. Homes assessed at below $250,000 were in second place with $1.35 billion in value after increasing 22%. With a jump of 27%, homes worth between $500,000 and $750,000 climbed to $1.01 billion. Combined with rising tax rates, these value spikes could make many of these properties unaffordable now or in the future.

The high-end homes of Leyden got smacked with the largest increases, though they were responsible for a relatively small slice of the total value. Those assessed at $750,000 to $1 million rose 32%, while those worth between $1 million and $1.5 million jumped 45%. The most expensive homes saw one of the largest increases of the 2025 reassessment, surging 108%. This titanic increase took the combined total from $32.59 million to $67.78 million overnight.

Northern Cook County Hit Hard by Reassessment

Leyden Township is seeing some strong surges across all residential properties but is far from the only area to be hammered. Barrington experienced a housing value spike of 33%, while Elk Grove rose 28%. Norwood Park experienced an overall jump of 19%, with high-end homes increasing by 58%. Northfield saw the taxable value of housing increase by 30%, while Maine Township went up by 25%. Evanston was another victim, increasing by 23%. While residential properties across the county have certainly been hit with record rates, commercial properties seem to be getting worse.

Leyden Commercial Properties Spike 43%

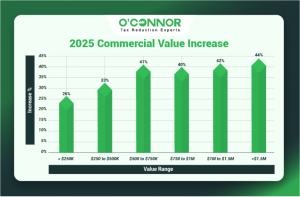

After the debacle of the 2023 reassessment and the ensuing outrage, it was discovered that property tax appeals were taking the burden from businesses and putting it on homeowners. In an effort to rectify the situation, the CCAO stated they would prioritize businesses for increases over homes. This seems to be the case in 2025, as the trend seen in Cook County, even in townships outside of assessment, is for commercial value growth to outstrip residential increases. This is certainly true in Leyden, where businesses saw their value jump 43%, reaching a total of $7.24 billion.

At the heart of the increases were commercial properties worth over $1.5 million. These mammoth properties usually account for the majority of value in Illinois, and Leyden followed this trend in spades. Suffering a massive increase of 44%, these businesses shot up to a grand total of $6.23 billion, which is 86.09% of all commercial value in Leyden Township. This obviously had a major impact on the overall value of commercial properties in Leyden. While these large businesses had an outsized effect, smaller properties were hit just as badly by the CCAO.

Commercial properties worth between $1 million and $1.5 million jumped 42%, while those worth between $750,000 and $1 million increased 40%. The second tier of properties did no better, with those assessed from $500,000 to $750,000 experiencing an increase of 41%. Businesses that were worth between $250,000 and $500,000 took third place in total value and grew by 33%. Even the smallest of commercial properties, those worth less than $250,000, saw their taxable value spike by 26%.

Errors Continue to Haunt Cook County

One of the reasons that property taxes are becoming mandatory in Cook County is that the CCAO has made many blatant errors that have forced the hand of taxpayers. Under scrutiny from the 2023 reassessment, it was found that many properties were not just measured incorrectly but classed wrongly. Empty lots were valued like mansions, large businesses were assessed as much smaller, and there were many other errors that even a quick second glance would discover. In 2025, it was announced that tax bills and refunds would be delayed due to a widespread computer error. This also casts doubt on assessments from the previous few years, in addition to the ones that are currently ongoing.

Property Appeals are the Remedy

Despite the controversy over appeals favoring businesses over homes, property tax protests are the only option available to most taxpayers. Whether it is a home or business, it is clear that every assessment should not be taken at face value. Even the CCAO themselves, who make the assessments, are encouraging protests. This is a sign that every taxpayer should file an appeal as soon as possible, as the CCAO is basically admitting that their numbers are questionable.

Things have gotten so bad that it is recommended that taxpayers protest their taxes every year if they can. This establishes a true value for a property, which can then be used in the future to help protect against reassessment. It can also be used to recover some value from previous rises. In many areas impacted by the 2023 reassessment, such as Cicero and West Chicago, many property values are going down thanks to appeals, a true miracle in Cook County. Until the property value issue can be fixed legislatively, it is up to every taxpayer to be stewards of their own property.

Initial Appeal Deadline Set for September 2, 2025

As stated above, there are multiple deadlines that the people of Leyden Township need to be mindful of in their property tax appeal journey. The cut-off date for informal appeals with the CCAO is set for September 2, 2025. If this date is missed, taxpayers can still take their appeals to the Board of Review (BOR) though those appeals are not open yet. The BOR is seeing record numbers in 2025 and is quickly becoming the favored appeal method. Still, informal appeals to the CCAO can provide relief and are simple to carry out. If an informal appeal is rejected by the CCAO, then a taxpayer can still go to the BOR at a later date. While the date for BOR hearings is not known, it is usually a few months after the informal appeal deadline.

About O'Connor:

O’Connor is one of the largest property tax consulting firms, representing 185,000 clients in 49 states and Canada, handling about 295,000 protests in 2024, with residential property tax reduction services in Illinois, Texas, Georgia, and New York. O’Connor’s possesses the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs a team of 1,000 worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ +1 713-375-4128

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.